Starknet onchain highlights:

– Among $10.82B total value locked across all L2s, Starknet has $133M, processed 388K+ blocks, 74M+ transactions, hosted 3.53M+ contracts and 3.56M+ unique wallets, transacted 10M+ ETH.

– Although Starknet has very high onchain reputation score and rank among other projects and L2s with 973,232 unique active wallets (UAWs), its user quality (average GRS per UAW 0.0085) is as equal as the average of the entire Ethereum ecosystem, much lower than the average GRS per UAW 0.02 of all L2s.

Primer on Starknet

Starknet is a ZK-rollup layer-2 to scale Ethereum, developed by Starkware. Starknet employs zkSTARK technology, having many advantages over zkSNARK used by zkSync (see Table 1). It has a virtual machine built on Cairo language, which is non-EVM compatible. Among $10.82B total value locked across all L2s, Starknet has $133M valued-dollar locked in its canonical contracts. Since its launch on 29 November 2021, Starknet has processed 388K+ blocks, 74M+ transactions, hosted 3.53M+ contracts and 3.56M+ unique wallets, transacted 10M+ ETH, at the time of writing. We will compare ZK-rollup layer-2 technologies based on zkSNARK versus zkSTARK in the following table.

| Characteristics | zkSNARK | zkSTARK |

| Cryptography primitives | ECDSA | Hash functions |

| Setup | Trusted initiation | Trustless |

| Quantum resistance | No | YES |

| Proving time | Slow | FAST |

| Verifying time | Slow | FAST |

| Scalability | Low | HIGH |

| Proving size | Small | LARGE |

| L1 gas cost | Low | HIGH |

| Applied L2s | zkSync | Starknet |

| EVM-compatability | HIGH | Low |

| Adoption | Higher | Lower |

Primer on Octan Reputation Score

Inspired by Google PageRank, Octan Network innovates a Reputation Ranking System (RRS) to establish trust and credibility in Web3 space. Octan’s Reputation Score (RS) is a metric to measure the trustworthiness and reliability of an account within a Web3 ecosystem. A higher Reputation Score indicates a higher level of trust and importance within the blockchain. RS captures Web3 social insights, user activities and behaviors via on-chain records: transactions, contract interactions, transactional volume, and gas spent; providing a universal, comparative, and quantitative measurement of the reputation of accounts within communities and the entire space.

Octan RRS employs sophisticated ranking algorithms (e.g. adaptive PageRank) to calculate the reputation scores of accounts (both contracts and individual wallets – EOAs) and analyze graphs of transactions recorded on chains, making RS a highly valuable metric for extracting social insights and user persona, evaluating dApps and their user quality in the dynamic and rapidly evolving Web3 ecosystems. Read more about the conceptualization of “Octan Reputation Ranking System”.

Ethereum Key Metrics

Octan Global Reputation Score (GRS or RS) assigns 1,000,000 reputation points distributed for all public addresses (accounts) on the entire Ethereum ecosystem within the calculated range. The analysis covered a block range spanning from November 2022 to September 2023 and yielded the following results:

| No. processed Blocks | 2,151,841 |

| No. processed Transactions | 570,471,340 |

| Total gas spent (ETH) | 1,938,222 |

| Addresses | |

| Total | 47,359,268 |

| Contracts | 1,567,957 |

| No of contracts with zero-GRS | 112,680 |

| Externally owned accounts (EOAs) | 45,791,311 |

| Externally owned accounts (EOAs) with zero-GRS | 9,332,520 |

| Average Global Reputation Score (GRS): arithmetic mean equals the sum of GRS over all addresses divided by the number of addresses. | |

| Contract group | 0.314 |

| EOA group | 0.011 |

| Non-zero EOA group | 0.014 |

| GRS Variance: measuring deviation of addresses’ GRS around the median, i.e. the middle value. Higher variance, father deviation of the considered group | |

| Contract group | 2955 |

| EOA group | 51 |

Global Reputation Score: overview on Ethereum

In this section, we delve into the analysis of the Global Reputation Score (GRS or RS) within the Ethereum ecosystem. Reputation Score (RS) serves as a valuable metric for assessing the reputation and quality of participants, including both contracts and EOAs (Externally Owned Accounts or individual wallets). The report serves as a valuable resource for understanding the performance, activity, and reputation dynamics within the Ethereum ecosystem.

Reputation value distribution in different groups

To gain a comprehensive understanding of reputation value allocation, we analyze the distribution across various groups. The tables and pie charts below present the number of addresses in each group and the corresponding total reputation value, allowing us to assess the importance and contribution of each group to the overall reputation within the ecosystem.

| Groups | No. of addresses | Total Reputation Value | ||

| Non-zero EOAs | 9,332,520 | 19.71% | 0 | 0.00% |

| Zero EOAs | 36,458,791 | 76.98% | 507,760 | 50.78% |

| Contracts | 1,567,957 | 3.31% | 492,240 | 49.22% |

| Total | 47,359,268 | 100% | 1,000,000 | 100% |

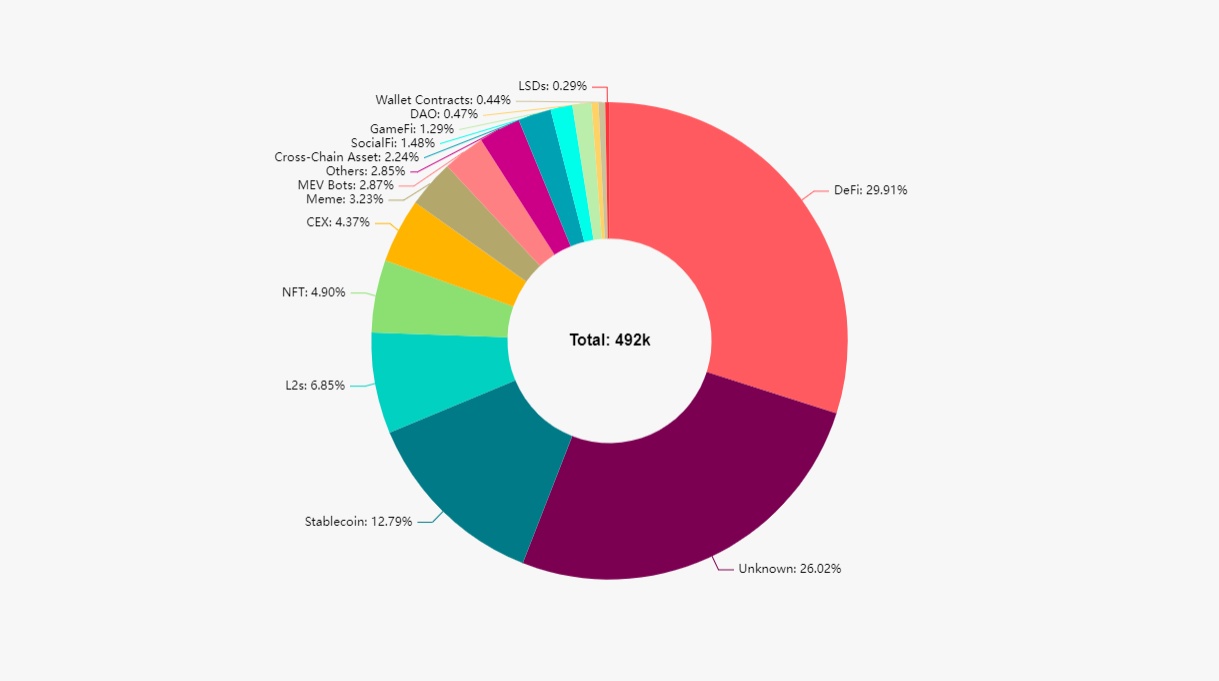

Reputation of Categories in Contract Group

In this section, we uncover an in-depth analysis of the Global Reputation Score (GRS) specifically focusing on Contract addresses within the Ethereum Blockchain. The number of computed contracts is 1,567,957 equivalent to 3.31% of the total considered addresses, but their total reputation values 492,240 scores accounting for 49.22% reputation points on the entire ecosystem.

Considering the group of all contracts, DeFi and stablecoin are the Top2 categories on Ethereum, respectively accounting for 29.91%, 12.79% reputation value of the contract group. Contracts of layer-2 protocols and NFT projects account for 6.85% and 4.9% of reputation value, while SocialFi, GameFi are 1.48% and 1.29%, respectively.

We classify contracts into various categories: custodial contracts of centralized exchanges (CEX), contracts handling cross-chain assets, Decentralized Autonomous Organizations (DAO), Decentralized Finance (DeFi), GameFi, SocialFi, NFT, Liquidity Staking Derivatives (LSDs), MEV-bots, meme tokens, stablecoins, multisig wallet contracts of reputable institutions or VCs, and identified but unclassifiable contracts. The remaining is unknown contracts.

On the Top 10 Contracts on Ethereum by Reputation Score, corresponding with their UAWs and average RS per UAW, Dollar-pegged USDT stablecoin (Tether) contract continues to be No.1 with the highest GS (~48.5K) and of UAWs (5.6M+). Uniswap routers and Centre USD Coin follow. The zkSync Era and Starknet contracts have very high ranks of #8 and #13, large numbers of UAWs, 1.7M+ and 902K+, respectively.

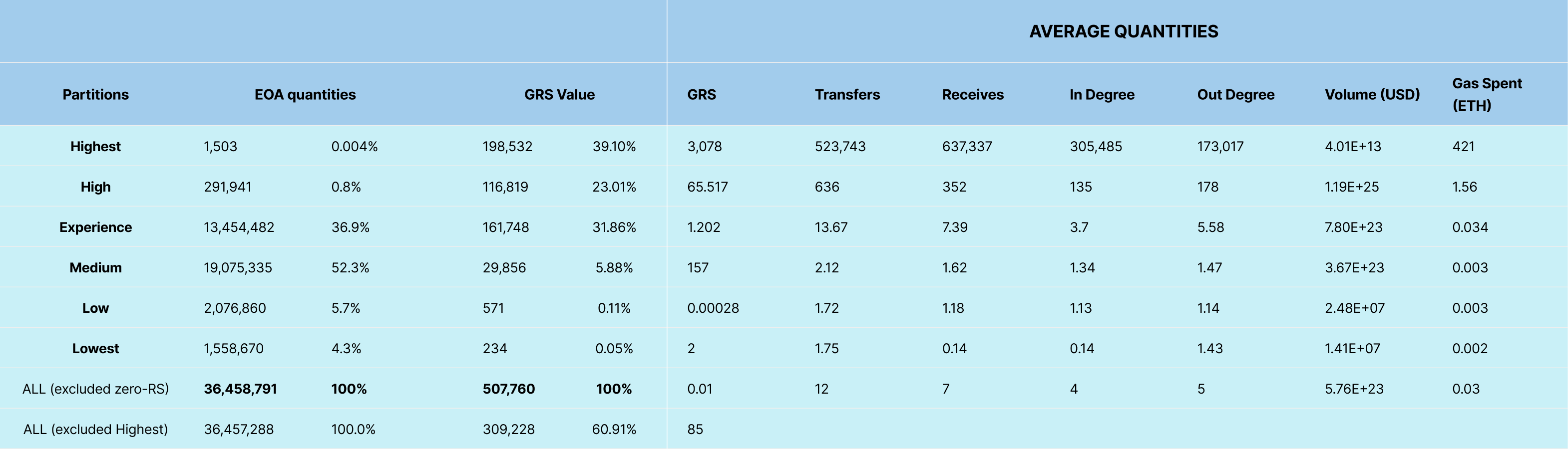

Ethereum user partitioning

We explore the partitioning of Global Reputation Scores (GRS or RS) on externally owned accounts (EOAs) within the Ethereum ecosystem. Then, we compare with unique active wallets (UAWs) of Starknet later. This is a comprehensive and useful measurement for user quality and user segmentation on the blockchain.

- No of EOAs on Ethereum: 45,791,311

- No of EOAs on Ethereum with zero-GRS: 9,332,520

Layer-2s: onchain Reputation & Statistics

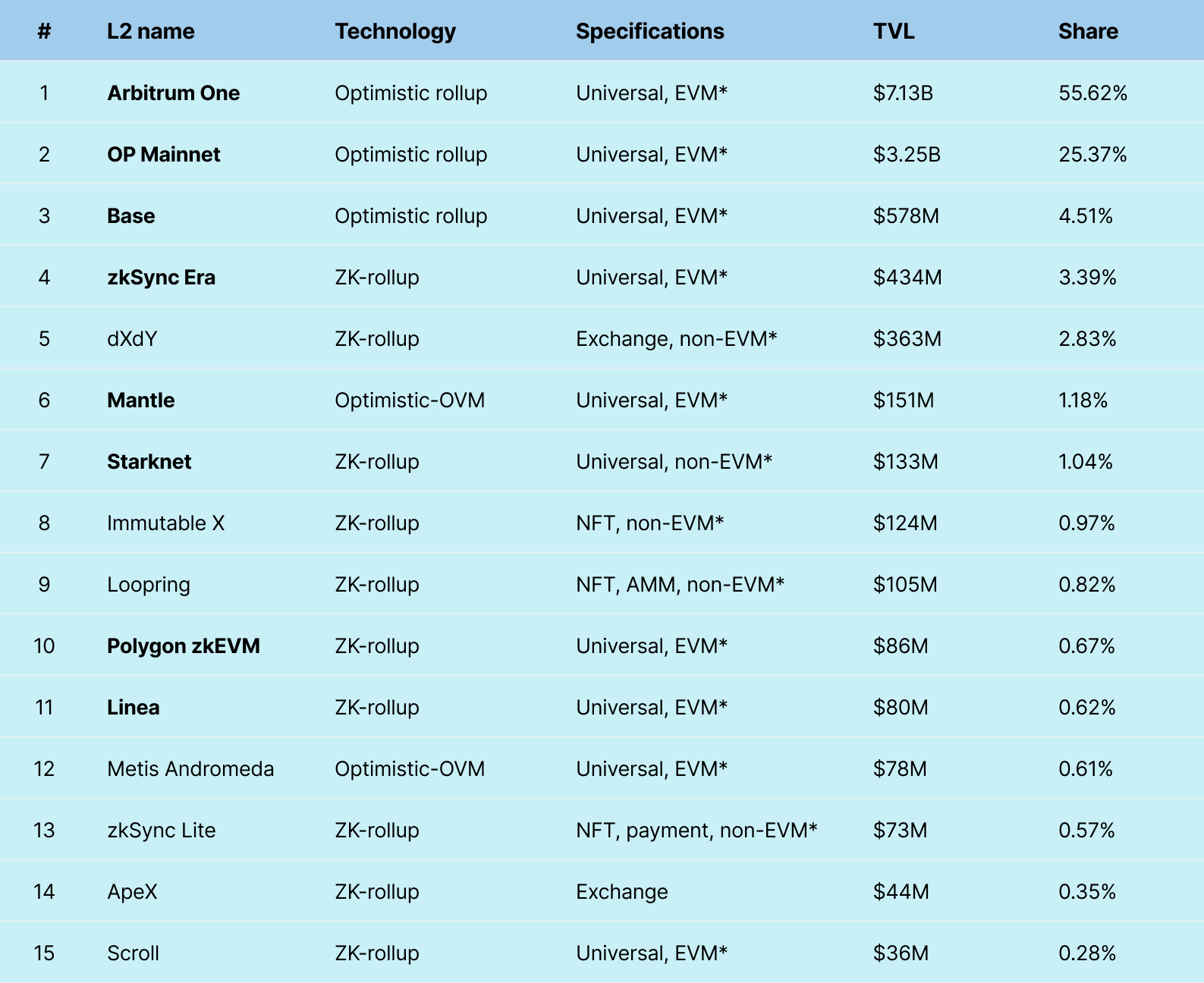

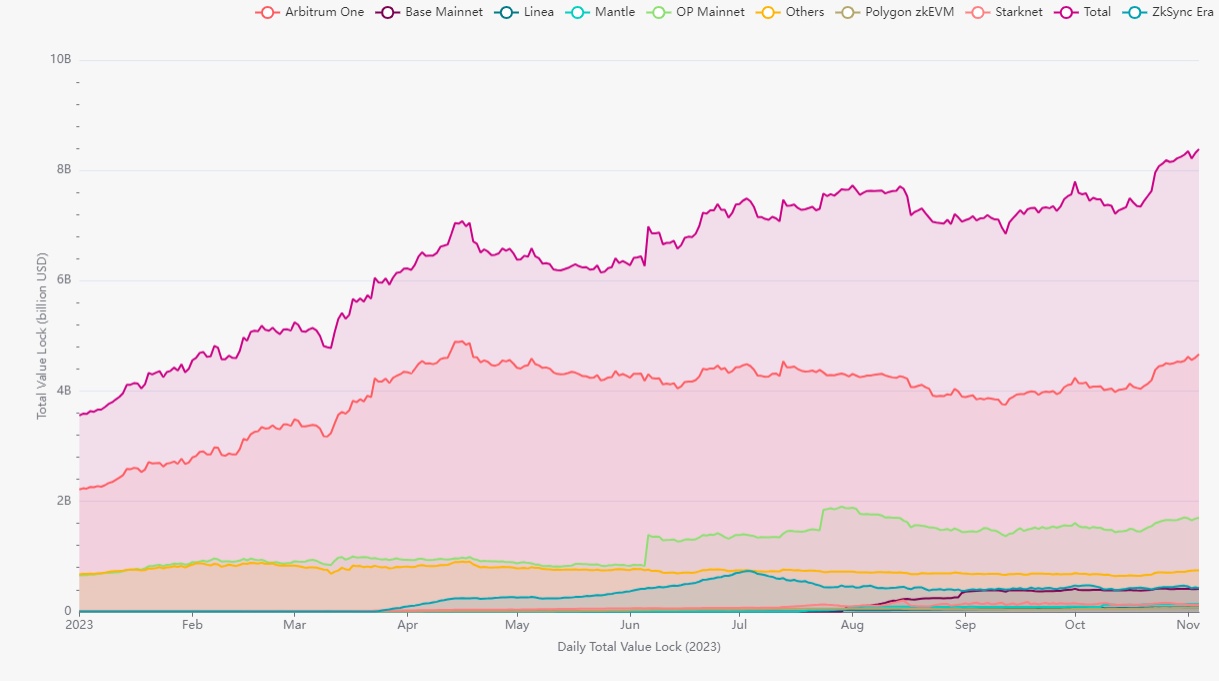

Total value lock on Layer-2s

Among $12.82B total value lock (TVL), across all layer-2 projects on Ethereum, we briefly provide statistics of Top15, accounting for 98.83% TVL. EVM* means EVM-compatible. TVL here includes the value transferred to L2s via canonical bridges from Ethereum to L2s or external bridges from other chains to L2s, and the native stablecoins (USDC) and tokens minted on L2s.

Layer-2s performance

In the following table, we investigate deeper about the onchain performance of layer-2 projects, considering activities on Ethereum only (not on the L2s themselves). Global Reputation Score (GRS), in general, treats all accounts on Ethereum fairly, while Category Reputation Score (CRS) prefers a specified community (e.g. herein, layer-2 communities and L2 contracts on Ethereum). Emerging L2s (e.g. zkSync, Starknet, Zora, Base) have attracted hundreds of thousands of new users from Ethereum moving to L2s to experience new infrastructures and to hunt airdrops in the future, resulting in high L2-categorical & global reputation scores. In contrast, Arbitrum and OP Mainnet (Optimism) have a pretty stable user base, hence lower reputation scores, despite much higher TVL.

User activities on Layer-2s

In this section, we explore the user activities on L2s over a time range from Jan 2023 to now. Average RS counts for all EOAs, while EOA* excludes CEX hot wallets and zero-RS wallets.

Starknet: onchain Reputation & Analytics

| Starknet canonical contracts | GRS | Global Rank | L2.CRS | L2 C.Rank | Performance |

| StarkNet: StarkGate ETH Bridge | 5298 | 13 | 110611 | 2 | Excellent |

| StarkNet: Core Contract | 364 | 183 | 0.84 | 13371 | High |

| StarkNet: StarkGate USDC Bridge | 21 | 2416 | 489 | 101 | High |

| StarkNet: StarkGate USDT Bridge | 9 | 5430 | 216 | 185 | High |

Starknet: User Acquisition & Quality

Starknet: user quality partitioning

The wallets in the highest partition by GRS are hot wallets of centralized exchanges. Although Starknet has very high onchain reputation ranks among other projects and L2s with 973,232 unique active wallets (UAWs), its user quality (average GRS per UAW 0.0085) is lower than the average of the entire Ethereum ecosystem (o.014), and much lower than the average GRS per UAW 0.02 of all L2s. Fortunately, user partitions of Starknet highlights 95% of UAWs in experience and medium users, higher than the entire Ethereum (89%).

Starknet: user acquisition

We explorer the numbers of UAWs and transactions of Starknet users, daily and monthly in 2023.

Starknet: user segmentation

The following charts demonstrate intersections of Starknet users with other categories, time-framed by monthly and 2023-accumulation.

About Octan

Establish Trust and Credibility in Web3

Octan Network is an award-winning data analytics provider in the Web3 space, achieving recognitions from industry-prominent organizations: BNB Grant DAO on Dorahack, Web3 Matching by BNB Chain, Octopus Accelerator Program, DFINITY Developer Grant Program.

Octan Network, instead of focusing on cash-flow & financial analytics, we use our unique Ranking Reputation System (RSS), inspired by Google’s PageRank, to provide reputation and ranking scores for accounts across chains and applications. By qualifying, classifying, evaluating, and extracting social insights from Web3 entities, our system provides the best quality analytics and the most multi-dimensional insights on Web3. Applications of Octan Reputation Ranking & onchain analytics:

- User segmentation: By leveraging new data sources and advanced analytics tools, RRS provides valuable insights about entities in the Web3 ecosystem. This enables projects and marketing agencies to utilize reputation scores and analysis reports to effectively classify, qualify, and segment users and audiences in the Web3 space, aiding in user acquisition strategies.

- Investment research: Investors can utilize the RRS to gain a comprehensive assessment of a project by analyzing the activity levels of the project’s contracts and the quality of user wallets interacting with those contracts; helps investors easily select promising projects based on reputation and performance, enabling them to conduct more in-depth financial analysis

- Onchain research and analysis: Researchers and analysts can leverage the RRS to identify emerging trends and opportunities in the Web3 space through the transformations in the reputation of Web3 entities. By studying these reputation changes, they can gain valuable insights into market dynamics, user behavior, and ecosystem developments.

Octan’s onchain analytical reports provide a comprehensive view of the Web3 ecosystems and its entities. These reports, produced by Octan data analysis experts, offer reputation scores of notable entities and segmentation, providing valuable social insights and social interaction within the Web3 space. Furthermore, Octan offers visualizations showcasing relationships and connections between Web3 entities. This allows clients to easily comprehend and interpret the reputation data generated by Octan.

- Visit our Gitbook at https://docs.octan.network/ to learn more.

- Visit Octan comprehensive reputation reports.

- Read Octan Reputation and Onchain Analysis Blogs https://blog.octan.network/

- For access to the detailed ranking table and more comprehensive information, please feel free to contact us ([email protected]).

- Visit our socials: Twitter | Facebook | Telegram | Linkedin